Net worth is all what matters, right? After all, there’s so much written about it. So many people who secretly (or not so secretly!) compare themselves against others. Looking to see how they stack up in the money stakes.

And when it comes to the early retirement and financial independence arena it seems to step up yet a notch further. I get it, net worth is an important part of the calculation of when you can afford to retire early.

But it is only a part of that calculation – and I’d argue it’s not the most important part by a long shot. Instead, I’d politely suggest (hey, I’m British) that cash-flow is what you should really be concentrating on when making your financial plans.

And here’s why…

Chasing Net Worth

At the start of the financial independence journey it’s very easy to see why people focus on net worth. I’m including myself here too for those wondering.

After all, it takes money to make money. A decent savings rate will only ever get you part of the way. Maximising earnings and investing well will always end up being the big financial levers. The ones that will really speed up your path to that elusive magic number you are chasing.

Fortunately, at this stage of the game it’s much easier to take the risks that will, hopefully, deliver the growth you want.

The debate will ever rage on between passive or active investing. Stick with a simple world tracker? Dive into crypto or property? Can the US really continue to power on? Etc etc.

That’s an entirely different subject and one well covered by others such as Monevator and the like. All I want to highlight now is that it’s much easier to take risk early on.

You have time on your side for the markets to do their thing. Riding out the highs (and undoubtable lows) is much easier when you aren’t relying on that net worth number for an income. Whilst you’re still working and earning an income, you can handle the extra risk.

But what happens when you pull the trigger and retire?

I've Hit My Target - I'm Done - Right?

So, yes. Congratulations, you made your net worth number. That’s awesome and well done. I know first hand it’s not easy.

But (like, who couldn’t hear a ‘but’ coming..) – just how did you calculate that net worth number in the first place?

A lot of what you will read in the financial independence arena will suggest it’s pretty simple. After all, the infamous 4% rule is all you need. Or 3% or whatever your view on a safe withdrawal rate happens to be. It’s mathematically proven, right?

Unfortunately, as many people have been learning through the SAGE covid modelling, a financial model is only as good as its inputs and assumptions.

I don’t disagree that the maths behind the 4% works. I’m a mathematician myself, so how can I think otherwise?

The problem I see is where people then try and apply the same logic to a situation which doesn’t match the assumptions used in the model.

Say, like, retirement for one. It’s not uncommon to see people wanting to both have and eat the proverbial net worth cake. I mean, yum, who wouldn’t want that?

But what do I actually mean here? Well – simply that it’s not unusual to see people talk in one breath about using the 4% rule to calculate their required net worth. And then follow it up swiftly with how they expect to de-risk their portfolio once they retire. You know, the usual kind of stuff, lower equity, higher bonds etc.

The two just can’t go together – as much as we would love them to.

You can’t have a lower risk portfolio and expect the same level of return as a higher risk one

Irritating, yes. But anybody who tells you otherwise probably doesn’t know what risk they are actually taking.

So – am I all doom and gloom and why bother? Of course not! Knowing the problem is half the issue – the far more interesting part is what can you do about it?

Eating The Net Worth Cake

There’s an obvious answer to the ‘calculating how much net worth question’. But it’s not particularly popular. Why?

Because it means using a lower expected return to calculate your net worth. And yup, you guessed it – that means a higher net worth figure to aim for.

But if you are dead set on minimising your financial risk in retirement, it’s one of those evil necessities I’m afraid. You can’t expect to hold a portfolio like Vanguard’s 20% bond 80% equities portfolio whilst wanting the kind of safe withdrawal rate of the 80/20 version.

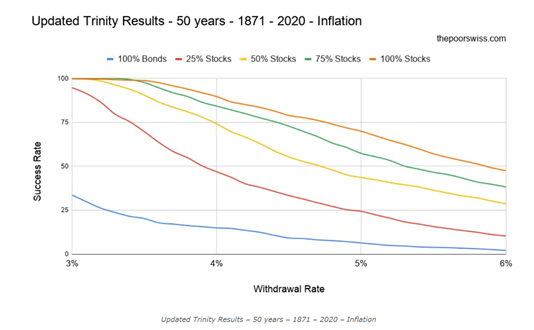

The Poor Swiss blog does one of the best jobs I’ve seen of going into detail on this and I thoroughly recommend anybody who wants to dive deeper to go read more there.

They’ve gone to great lengths to update the Trinity work and created some really useful graphs such as this one;

It shouldn’t shock anybody but the less risk you are prepared to take – the lower the expected return you should use.

What this all means is that one of the most useful things you can know is;

How much risk are you prepared to take in retirement?

It’s a very different question and not always the easiest to answer. But it at least gives you a better shot at having your net worth calculation in the right ball park. How? By ensuring your own personal risk tolerance and resultant expected returns are at least in sync.

I know it sounds obvious but from my own personal experience it’s a very different thing to ride out a big market correction when you no longer have that regular income from work.

And that’s why for me at least, cash flow is far more important than net worth. This is why..

Cash Flow Is King

Beyond bizarre bragging rights, net worth by itself seems a pretty meaningless number.

What matters is what you can do with it. And if, like me, you are using it to retire early, that means converting it into actual cash flow.

Like most, when I was working and still in savings mode it was pretty simple stuff. Happy to take risk on with a 100% equity portfolio. Some active, some passive. Maxed out those pension contributions, ISA’s. Buy to Let’s. All the usual good stuff.

But now my portfolio looks quite different – it’s no longer focused on what produces the biggest net worth growth.

After retirement – cash flow is the focus of my investment portfolio

Now I know, I know. The whole simple FIRE idea is to establish a safe withdrawal rate and sell off the right percentage each year to create that cash flow.

The practical and psychological reality I’ve found is that it’s far harder to want to sell investments after you’ve spent years saving for them. Plus it all just seems a bit….fiddly…for lack of a better word?!

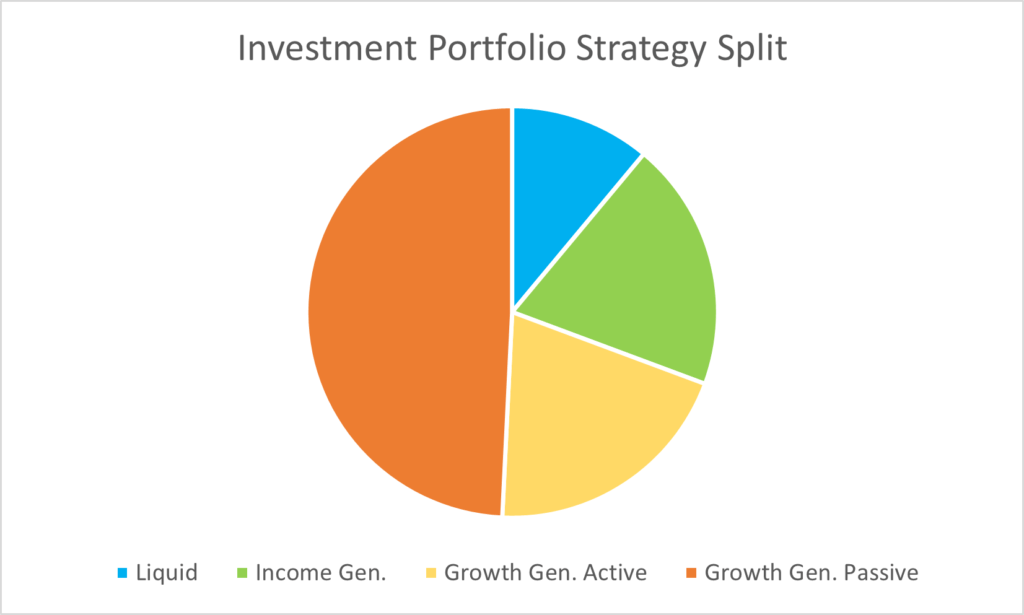

Instead, my approach is to split my net worth between three different types: Liquid, Income Generating and Growth Generating.

I don’t have it quite how I want it yet – but it looks roughly like this;

I’ve written before about the ‘delights’ of having your trading portfolio effectively frozen for over a year. It’s not a lot of fun.

Without those alternative sources of funds – it would have been a whole lot worse than just ‘not fun’.

Hence the ‘liquid’ part of my portfolio above.

Admittedly it’s much larger than I want it to be right now, but that’s largely down to some inheritance money I’ve yet to decide where to invest.

Where I seem to diverge from a lot of what I read though is on the next slice of pie – Income Generation.

I suspect most people would probably have expected this slice to be the traditional bond focus. But I just can’t bring myself to invest in any kind of bond, especially whilst the yields are so low.

So instead this slice aims for investments that fit the bill of delivering actual cash flow at an accepted cost of a lower expected return vs equity markets. Lower risk, lower return remember.

The upside for me is that this slice returns a healthy lump of cash each year. Not enough to cover all living expenses. But enough to cover the ‘Musts’ plus some.

It’s another whole post I suspect about the diversification and mix I have in here. What’s important for now is that having this makes me feel comfortable about riding out the volatility associated with the final slice of the pie, Growth Generating.

This slice is 100% equities. Some passive, some active. I tend to have an active ‘future’ pot where I invest in my views of what will be big in 15-20 years of so. And then balance this out with a larger passive ‘let’s just be happy to take the average’ pot.

The long term returns of this slice do their job of keeping the overall real portfolio return up. And I’m happy to take the risk since I know I have the cash flow to ride out the inevitable market volatility

Cash Flow - The Real Goal Of Early Retirement

At the end of the day, for me, investing after after retirement is all about one thing.

What’s the simplest, least risky way to generate the cash flow we want each year until we expect to die?

I don’t need to grow the net worth pot bigger any more. I don’t have to always be looking to maximise returns. Take risks I’m uncomfortable taking. Worry about missing out on the latest money making trend.

I don’t want to spend hours on spreadsheets or days reading financial reports. I did enough of that back when I was working!

What I want is a portfolio which lets me live the life I want to.

Of course there’s a huge number of assumptions in my approach too. There will be in any investment strategy. As ever, I’m firmly not saying this is the right answer for everybody!

But at least I understand my assumptions. I’ve thought about what I need and the risks I’m happy to take. I’m clear on the the purpose of every pound invested. Each has a job to do, a focus.

The underlying investment products may change over time as may the composition as pensions kick in later down the line. But the strategy should hold. As ever, time will tell and we’ll see I guess!

But for me – that’s why focusing on cash flow will always win out over net worth as the most important number when figuring out your own investment strategy.

Though honestly – I think just having a strategy you understand is what really matters. Not one you just borrow from others without knowing why it would be good for you – or not..

Thoughts? I’d be curious to know the investment strategies of others for sure.

Other Scribbles You Might Like?!

Are you ready for early retirement? The numbers may say yes - but...

Read MoreNet worth or cash flow? Which should you focus on for your investment...

Read MoreA lot of people wonder if they will miss working in retirement. This...

Read MoreLike a lot of people, I've always got a lot out of helping...

Read More

Hey, There

Nice post.

Are you familiar with the floor and upside (F&U) approach favored by economists?

Hey Jenny – thanks!

Yeah, I am now thanks to Al-Cam. I actually like that I figured out this approach worked for me first – and then found out it’s name 🤣. I’m a big fan of first principles thinking.

Cheers, Michelle

Pingback: Plutus Awards Weekly Showcase: January 28, 2022 - The Plutus Foundation

Nice post.

Are you familiar with the floor and upside (F&U) approach that is favoured by economists?

IMO, some of the best explanations/discussions on the F&U approach can be found at the late great Dirk Cottons Retirement Cafe website.

http://howmuchcaniaffordtospendinretirement.blogspot.com/ provides a more actuarial slant to F&U.

Hey Al Cam. No, I hadn’t heard it called that but makes a lot of sense. I always like to do things the hard way & invent it myself 🤣

Thanks for the link – you always have some interesting places to go read more – cheers.

You’re welcome.

This is a pretty good jumping-in point that ties those two sources together:

http://howmuchcaniaffordtospendinretirement.blogspot.com/2021/02/building-your-floor-portfolio.html

Very good points raised. The most important is net income after inflation. This is not necessarily the actual income paid by an investment. It could be the same, lower, or higher.

For real estate it’s probably the same, assuming you set aside part of the rent to cover maintenance expenses.

For growth equities, as well as those that favour returning capital to shareholders via buybacks instead of dividends, the actual net income is obviously higher than the dividend income. This is the case nowadays at an index level as well. Global equities yield less than 2% but actual net income is arguably more than 4%.

There are high yielding equities that have actual net real income less than their dividend yield. Treating the dividend yield as a SWR for them would be a mistake.

Same applies to bonds of other fixed income products. You should probably deduct inflation from the bond yield to get to a safe net income figure.

My approach at the portfolio level is to track the net worth, but with the intention of having a net income derived from that net worth, which means I need to always have an idea of long term real rates and market risk premia. This also means to be a aware of the fact that a change in net worth could be due to interest rates changing rather than future real income prospects changing. In that case I should adjust my required SWR accordingly. With rates at record lows last year for example, a SWR of 4% is not enough. Frankly, for a 50 year time horizon I wouldn’t even consider 3% safe, and personally was considering 2.5%. With rates rising this year this probably goes back to 3%. But then risk assets repriced accordingly, which results in approximately the same end income – which makes sense.

Hey London Dad – cheers for stopping by & the detailed comment, love it. So many different ways people see the same subject.

Totally agree that what matters is net income after inflation. I always first work out what the actual income is, i.e for real estate it would be rent less expenses and an allocation for future maintenance + expected void periods, bad debt. And then deduct my own personal inflation view, since it tends to be made up of a different basket of items to that used by the official statistic. Thus arriving at a real actual return, for lack of a better term.

Whichever asset class, an inflation adjusted measure is going to be lower apart from in a world of deflation obviously. And so absolutely, the longer you plan of being FIRE’d for, the more adaptability you need in both your budget and view on SWR.

Totally agree. I track net worth because it’s fun trivia, makes me feel good, and is like a security blanket for keeping perspective when financial surprises crop up, but cash flow is king. I want to see money hitting my bank account every month for my bills. And we’re not retiring until passive cash flow (mostly real estate income for us) is at an acceptable amount, regardless of how many millions our net worth might be. That’s particularly true since a lot of our net worth is tied up in real estate and retirement accounts that are tricky to tap into!

Hey Mrs FCB – love the blog name!

It’s surprising how comforting that monthly income is right. Rentals in our part of the world became not worth the work for the returns but I totally get the appeal where they still work out well for sure.

Interesting to see the difference between people – in the FIRE world you read so much about the 4% rule et al but very few people seem to live 100% by it from what I’ve seen. A bit of balance is a good thing for sanity I think!

Thanks for a great article! You mention giving up income-producing assets in favor of other income-producing investments, but you don’t go into describing what those are and percentage breakdowns! Are they dividend ETFs, etc.? Can you give your readers more details? Thank you in advance for your kind courtesies!

Hey, thanks – appreciated!

Tbh I thought about it and realised I’d be better off going into that properly another time. So it’s on the list as/when I get there for sure!

Cheers for stopping by & commenting, it’s really interesting hearing what everyone thinks.

Thank you for your explanation, and we all look forward to reading your detailed breakdown in the future…

Net worth is a good goal, but cash flow pays the bills.

Ha – nicely summing up everything there!

Cheers for taking the time to comment

I’m focused on both net worth and cashflow. Before stopping work, I tracked both. In early drawdown I prioritised income growth, i.e., my cashflow, and maybe reached for income yield too much. Now I’m aiming to maintain my income (cashflow) whilst seeking more growth. The growth part of my portfolio is only 12.54% of the total but is steadily being increased.

Hey – cheers for taking the time to share – it’s really interesting how other people approach this.

I think you’ve hit on something there too – it’s all a bit of learning as we go about what actually works for us in reality. Sounds like your rebalancing to growth is such a move. Congrats on stopping work though – hope you’re enjoying it!

I feel that net worth and cash flow aren’t so much an either/or option, but two terms that are very closely joined at the hip. For example, I could have a moderate risk appetite and apply that to invest in a cash flow producing portfolio (let’s assume that means stocks paying dividends) or I could invest in a growth focused portfolio (let’s assume no dividend, just capital growth) and simply sell stock to generate the cash I need for my early retirement. Everything else being equal, these different approaches should both generate the same outcome, but one might be called a cash flow approach and the other more of a net worth model…tomato/toma(r)to😁

Hey David.

ha, yeah – I totally agree they are intertwined. I think what I’ve found from my experience so far is it’s harder to want to sell cap. growth investments to raise the cash flow than you think once you’ve retired. A buy/hold strategy on cash flow producing assets suits me much better. I actually have a bit of both to make the most of the different UK tax allowances obviously.

The one thing I do think holds true is that having cash flow is a good psychological and financial buffer to riding out the volatility on the cap. growth type investments.

But yeah, potato/potatoe 🤣

Ah, yes, I think your point about it being a mental challenge to sell assets to generate cash flow makes a lot of sense.

I think you probably need a to have a mental model that does a bit of both (net worth and cash flow type thinking). I definitely don’t think one or the other is the ‘right’ way to think about things.

This article prompted me to reread https://occaminvesting.co.uk/is-dividend-investing-a-good-strategy/ to remind myself that dividend/cash flow thinking is really just a bit of a crutch, but if you’ve got a broken leg, then a crutch may be just what you need (we all have psychological broken legs right?)

Also, I think empirical is better than theoretical in personal finance. I find it more valuable to hear what people have done, rather than what they think they’ll do, so really appreciating this post in that department.

I’ve done a similar thing and take some dividends month in month out, but I’ve also bought (and now once read through) a copy of Mclung – so I’m trying to keep both models alive in my little grey cells.. will have to read it a few more times to get it to sink in, there’s no getting away from net worth type decumulation being a *lot* more complicated. But then again, the ‘capital untouched’ aspect of dividend or rental type cash flow thinking is pretty unfeasible for most also?

You are damned if you do, and damned if you don’t! In a nutshell, you’ve got to do both..

Hey Rhino, nice to hear from you

Tbh, net worth and cash flow are so obviously intertwined you can’t think about one without thinking about the other. I entirely agree there’s no ‘right’ way to think about any of this – to me what’s really important is working out what works for you & knowing why you are doing it. In that vein, absolutely ‘income’ is a crutch – but one that balances out my portfolio without low paying bonds.

I guess it’s not that different to having our home mortgage free. Intellectually I know it’s not a good use of money. I could easily get a low rate mortgage and make more by investing the released capital. But I don’t need that extra income or growth, I have more than enough already.

I think that’s what I was trying to get at is that you don’t always go for the best returning portfolio – there are valid, all be it emotional, reasons to do otherwise. And yeah – it is defn different doing it in reality as opposed to theory so good to hear it’s useful.

As a total aside – it’s funny how most people assume dividends when thinking about income. I’ve actually got a bunch of different stuff which helps to diversify the chances of them drying up at the same time!

Cheers again!

Thanks for writing this Michelle, it is an excellent articulation of the how and why behind your “decumulation” plans.

I echo your sentiment about the importance of cash flow. Net worth is great for bragging rights, but it is cash flow that pays for the groceries!

My approach was similar, stacking up passive income streams to cover off the bills one by one. Required a bigger pile to feel secure perhaps, but that also builds in a margin of safety. I started questioning that approach a little as I began divesting real estate (and the associated use of leverage), replacing it with other investment classes that don’t generate as strong cash flows.

In the end I taught myself to focus on total real returns but, like you, I consciously maintain a mixture of income and growth focussed investments. The income to contribute to/cover my immediate living costs today, the growth to try and ensure that my living standards are maintained for as long as I’d like them to be.

Hey Indeedably. Thanks! Glad you enjoyed it.

It’s funny how often the reality of FIRE is very different to a lot of what gets written about it. I’ve found there’s a big difference between theory and practice for sure.

We too divested most of our buy to lets over the last seven years or so, one a year for cap. gains purposes. The returns had shrunk to the level where the extra work and downside risks really didn’t outweigh simply investing the cash elsewhere. But yes, it did feel odd to ‘give up’ income producing assets, which is partly how the strategy evolved I think.

There’s a lot of flex in our plans so I’m pretty comfortable with them so far. We’re not far off we could simply live off the money for the rest of our lives without actually getting any return – which is pretty comforting. Let’s me likewise believe ( as best as anybody can!) that living standards and unexpected costs (good & bad) will be covered as/when needed or wanted. There’s a lot of upside to not living in London 😉

Cheers Michelle, a great read!

Your investment portfolio pie chart is a little similar to what I’m aiming for, with those 4 segments (although my ‘growth gen’ are lumped into one right now).

It’s what I’m trying to achieve by having some dividend income paying investments because I know for a fact that if I had to only derive my spends from actually selling investments, psychologically it would be very difficult and the dividend income is meant to help cushion that mental pain!

In 2021, that part of my portfolio generated enough to cover most all my basic expenses – like yours, it won’t cover all living expenses but enough.

Some will question why I’ve even got income producing investments already, while I’m still accumulating? Well I wanted to see it actually working for myself – I didn’t want to be pulling the plug only to find it doesn’t do what I expected it to! Of course, I just invest all the dividends right now.

I too agree that net worth is meaningless number. I was keeping some tabs on mine only because it seemed that so many in the FIRE community put so much emphasis on it but aside from that, it has no feature in my plans. My own focus remains on my FIRE/Future Fund, which will provide the all-important cash flow.

Hey Weenie – cheers, appreciated!

Awesome to hear I’m in good company with how I’m doing this. Honestly, the income piece really does help in that way and I don’t think it’s crazy at all to have that working already. We both wanted to see it working before giving up a job I knew it’s be hard to get back into.

Yeah, I really don’t get the net worth thing. Maybe it’s the simplicity of it I guess. I suspect as people get closer to actually pulling the trigger the focus switches as the reality of losing that regular salary bites!?