Yes, I know, I know, it’s been a while…. What can I say, life is still busy even when you are retired! For any of the really observant among you, you will also have seen this blog up and down over the last few months. As they say – a few technical issues transitioning from one hosting provider to another. A technical genius, I am not. Persistent – absolutely…

So – here we are – back online – and finally able to actually write something! So here we go….

A Milestone Moment?

I recently celebrated my 50th birthday. Unlike many people I know, I really didn’t freak out about leaving my forties behind. I’ve never been that fussed about the actual number. And it’s a good excuse for all kinds of celebrating.

But it does also make for an interesting point of reflection on how your life is going versus what hopes or expectations you had.

Back when we were first putting our plans together for the financial side of retiring early we had to pick an arbitrary number of how long we expected to live. And we both went for 100 – hence the post title ‘Halfway Through’.

For those interested, you can see our first attempts at planning on the FIRE Triangle series. In Part Two you can see our optimistic graph out to 100.

But how do you estimate that kind of number – and does it matter?

Do You Want To Live Forever?

In terms of financial planning, quite clearly the longer you expect (or hope) to live for will have a big impact on how much you need to have to retire happily.

Not many people will talk about this side of the equation. I get it, it’s not exactly a pleasant task to chat about over a nice cup of coffee. But it’s a massive elephant in the room you really don’t want to ignore when it comes down to planning your retirement.

It’s actually quite enlightening to use a decent life expectancy calculator, like this one from Big Project, which includes the impact of choices in our own control like diet and exercise. Whilst interesting to see the actual prediction, what I found most helpful was to run it with different scenarios. The aim being to see what lifestyle choices made the biggest difference.

For example, drinking less beer in my case actually decreased my life expectancy! Clearly this is the most accurate calculator ever…hmm… Conversely, gaining a few stone in weight knocked off a couple of years. So guess I’d better carry on with the healthy eating for a bit yet then.

Kidding aside – it’s a useful, if sometimes sobering, way to get an unbiased view of how long you likely have left. My estimate prediction right now is 90. On that basis I’m apparently over the halfway mark already.

That actually feels far stranger to think about than the whole turning fifty thing. I’ve already likely lived over half my life. Have I achieved over half of the things I wanted to do?

Whilst some people may consider this kind of thinking too morbid, I’ve always seen it as just being practical. Reminding myself we all have a limited number of years is a great kick up the backside to get on with things that I want to do or try.

It’s was also pretty vital in figuring out how much we needed to be able to retire early…

Keeping It Real..

For me, it’s always seemed pointless to set unrealistic targets. Far from inspirational they’re just pretty much guaranteed to see me and most people just give up before even starting.

This seems particularly true when it comes to managing your finances and planning for retirement.

Take the oft-quoted and to my mind ridiculously high £60k per annum for a couple to retire ‘comfortably’ . If you used the shorthand 25x rule, you’d need close to £2m invested to produce that £60k per year post-tax. Try telling that to someone in their twenties just starting out on £25k/year.

Two million pounds is just going to sound unachievable, so why bother even starting?

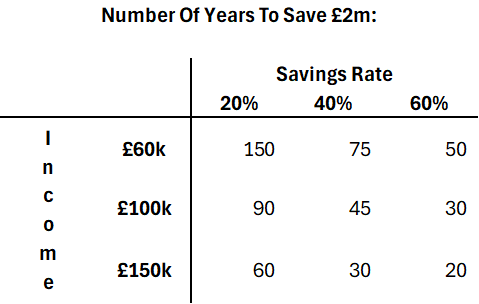

Just for ‘fun’, I put together some back of the proverbial fag packet numbers (should that be a vape these days?!?) as to how long it would take a couple to save that much based on different levels of income and savings rates;

Yes, I know, this takes zero account of compound interest and all that fun stuff. Like I said, it was for fun in ten minutes. But I think the, perhaps unsurprising, message remains that saving two million quid is going to be unrealistic for most people.

On the brighter side, I firmly believe that quoting that kind of annual expectation as ‘comfortable’ is just not very helpful for the vast majority of the population.

Most of us I suspect will never get close to spending that much per year. Our own spending since quitting my job has been surprisingly static between £35-40k each year, including all the travel.

It’s also not helped by most financial guidance seemingly targeted towards generating a permanent income level that will go on and on ad infinitum. Which is fantastic and all – but it does lead to a far larger requirement in terms of how much you need saved/invested to generate said income.

Taking the time to think through and make a realistic cash-flow plan is far more complicated to work out – which I suspect is why it’s not as popular. It’s not something you’re going to capture in a two minute Tik-Tok. Or whatever. I may yet have a stab at going through ours in another post at some point. No promises.

For now, let’s get back to the point of this one – how do I feel about being ‘Halfway Through’? Is this early retirement lark still working out?

Half A Story

If you ever read any of those articles about ‘How to Find Your Passion’ (come on, hands up, we’ve all done it….right?!), you will know they often talk about thinking back to your childhood. Remembering what brought you joy for no other reason than it just did.

That’s great and all, apart from when all you remember is making mud pies, antagonising your sister (sorry K!) and running around a lot. Difficult to decide what you want from life based on that limited information…

The internet was not a thing, connected or not, back in my childhood days. So growing up in a small rural village gave me a limited view of what the world had to offer. I do remember being very fond of my first proper globe though. Hmm….these foreign countries look interesting…

It wasn’t really until I left and went to University that I started to figure out there was a lot more I could do with my life than I’d so far considered. And the doors didn’t really open until my long-term boyfriend at the time rather unceremoniously dumped me. Moving on then!

Since then, I’ve experienced so much more than I ever dreamed of, both personally and as a couple. I had no idea we’d build our own home, often with our own dodgy DIY. Ending up mortgage-free in my thirties. Falling into a job that turned into a well-paid career. Quitting said job at 43 having achieved financial freedom. Spending anything between two to six months each year out exploring the world.

My other half summed it up nicely when scrolling through our photos to find something by saying “wow – my life looks amazing”. Sometimes it takes a step back to fully realise how far you have come,

Ofcourse it’s not all been good. We’ve lost wonderful people that we loved along the way. Leaving work and our home town saw friendships become infrequent meet-ups at best, rather than a quick half after a stressful day. Our general health may be better than in our thirties but it’s impossible to ignore the increase in grey hairs and ‘smile lines’. The increased invites to the doctor’s surgery.

That’s life for you. The reality is though, that at this halfway through point – I’m incredibly happy with where I am in life. I suspect that’s a big part of why I didn’t really care about turning fifty. It really is just a number on a journey.

But it’s a useful time to reflect. I feel minimal regret about my choices and a lot of gratitude. I’m also just as conscious that we need to continue to make the most of what luck and hard work have delivered us. And with any luck, when I’m turning sixty I can still say the same. Here’s hoping.

Other Musings From Me...

A lot of people wonder if they will miss working in retirement. This is what I've found since retiring early at...

Read MoreIf you're a natural planner like me - what happens when you go travelling for the first time without a plan.....it's...

Read MoreLike most things in life – the idea of early retirement seems to provoke a range of responses. One of the...

Read More

Thanks for sharing that calculator, it’s really interesting! What other tools have you been using?

Not many these days – and honestly, Excel remains our go-to, nothing else is flexible enough to match what we want to figure out.

It might seem morbid, but understanding how long you (might) have left is so key. Many people wait to retire until they’re at an age that stops them having the experiences they’ve always dreamed of.

Absolutely – which is mildly insane! I think people often massively overplay the financial risk and under play the physical ones. It’s all a balance – you don’t get to avoid risk, just choose which ones you prefer to take.

It’s refreshing to see such relatable figures for many of us in the FIRE space. Loved the point about how high figures like the “£60k a year = £2 million pot” can seem unachievable for most, but actually, real life spending in early retirement can be much more manageable. Here’s to making the next decades just as fulfilling as the first half.

Hey Sean. Cheers for stopping by and taking the time to comment – always nice to hear from others on their own journey 🙂

Yeah, I just seriously do not get some of the figures floated about, crazy talk and so unhelpful. Especially when an awful lot of couples don’t make that much even when both working full-time. I get it’s all part of the grand ‘nudge’ theory to encourage people to save more but there is a point when it will do the opposite if it just feels unattainable despite however hard you try. Far better to have an achievable and realistic target.

And absolutely – life is all about making the most of what you can do – and not accepting that which you can’t. Congrats on the blog btw – good luck on your journey!

Hi. I checked back today on the off chance there would be an update from you both. Congratulations on the birthday. The FIRE space is so dominated by the US it seems these days and it is great to hear some British voices, especially those who are living the dream!

Reflecting on your £2 million for £60k a year post-tax comment, if you believe half of what you see online nowadays people seem to feel they need even more! I’ve lost track of the “I’ve $10 million, can I retire?” threads on Reddit!!!

Anyway, just wanted to leave a comment to let you know there are still people out there who enjoy your updates. Thank you, and please keep inspiring us all!

Hey Neil. Thanks!! It’s comments like these that make my day – cheers! And funny, I’ve read plenty of those Reddit type comments too – crazy world at times eh. Glad to help keep a (relatively 🤣) sane and British perspective going. It never fails to surprise me how much we do on our budget compared to what others seem to think they will need. I know we don’t have kids which helps but even so!

We’ll be off to South Africa again for a couple of months soon but I will try and carve out a space to write something else this year. Cheers again for taking the time to comment!

Nice to hear back from you, after some silence from you. I resonated with your story (childhood, university, job, marriage, house) about “discovering” the REAL life. It took me a little longer to arrive to “enough” (with small E, aka I mean comfort) because I have rise a child, which now has her own child too 🙂

For two persons (my wife and me, both near age 60), EURO 2k-3K/month is average cost, to life well and have also 3 trips/year in Europe, each of 7 days; still “working” (I mean show our face to job for one-more-year game) until one of multiple (state, old-age) pensions starts to run for each of us.

Living in Vienna, so no rush to quit jobs. Saving rate average was 70-80%/year in each of latest 10 years. I really do not need more money [hm, I need to say it more often to my partner, maybe I will convince her in the end]. Same like your plan, 3k/month (+inflation increased) will last until 102 year old. But for us, until now, Spain and Greece trips are just sufficient to have a change / break from time to time. We need something to run into, because still no something to run away from.

Please keep posting. Fewer blogs of FIRE are still running.

Hey John.

Good to hear from you again too! That savings rate is crazy – but I know what you mean entirely. If I’d carried on working it would have been a lot of time lost for money that I’m lucky enough not to need. There comes a point when it just isn’t worth – there are many better things to try out.

I haven’t made it to Vienna yet but have heard plenty good about it – especially the beer! So one day….

And absolutely – always run towards something – you only defeat problems by tackling them head on, not running or looking away.

All the best – I shall try to post again a bit sooner this time! I too miss a lot of the good blogs that seem to have likewise gone quiet now.