(Re) Introducing The FIRE Triangle

For those of you who started at the beginning (congrats!) you’ll recognise this very orange diagram immediately. For those of you who have come here directly, you may like to start with the friendly orange smiley face first here. Or not. Either’s good but one way or another we’re now going to dive into the second of the FIRE Triangle elements – Money…..

Money. Personally I think it’s one of the strangest inventions of mankind – it’s worth very little in actual physical form these days. It ain’t going to help you much in a post-apocalyptic world. That aside – it’s what it can be exchanged for that really makes it worth anything to us.

Firstly – lets be clear that money can’t buy you everything that you want. There’s an awful lot more to having a good, happy life than what money can provide. Relationships, family, friends, health – all of these can’t be bought. Some more extreme scenarios aside, like Thai brides and replacement body parts. But that’s not really the remit of this blog. We’re here to focus on how using money as tool, as the means to an end – can support you in having a better balanced life.

In the first part of ‘Playing The FIRE Triangle’ we met the orange smiling face of ‘life scope’. The cheery one all about what you want to spend money on – the kinds of things you’d like to do and have in your life that money can provide. Now we’re moving on to look at different ways of funding those lifestyle choices.

Taking The Long Way

So you’ve figured out what you’d like your post-FIRE life to look like. Now you just need to know how to fund it. The good news is – at the heart of FIRE is something very, very simple.

It’s basically having enough independent sources of income to fund your desired level of annual spending.

There – that was easy enough, right.

And whilst it is simple – it’s at this point you may remember me mentioning no easy answers or quick wins? This is another one of those moments. Look away now if you aren’t up for getting down and dirty with how to fund your dream lifestyle. Read on to start digging in…

If you’ve read anything about FIRE before – you will probably have come across the 25x rule. The one which says that it’s as simple as taking your desired post-FIRE annual income, multiplying it by 25 and then that’s the number you need to save up to. Once reached, you can then ‘safely’ withdraw an amount each year whilst being highly confident of not running out of money. In effect, becoming Financially Independent and Retiring Early, if you still want to. Awesomely seductive in it’s simplicity, right.

Like all short-cuts though, if you don’t understand the assumptions behind it – you have no idea if they will work for you too. One of my favourite explanations on this is via this link from Mad Fientist from Mad Fientist. A great name and a great blog if you haven’t found it already. Trust me, it’s worth the read.

Don’t get me wrong – the 25x rule & SWR ( Safe Withdrawal Rate ) are both useful guides to give you a ball-park idea. But without understanding how they work and challenging those assumptions against your own circumstances – you are never really going to understand or trust that your plan will work for you. And that’s going to make it harder to jump when the time comes to pull the trigger on your new life.

Building Your Own Plan - Cash Flow Over Wealth

What makes people feel poor? My definition – when they want to have or do something but don’t have the funds to do so. If I’m sitting contentedly in a warm, sunny beer garden with a chilled drink in my hand – do I notice if my share portfolio value goes down. Nope. Do I notice when I feel like staying for one more but have run out of cash and they don’t take plastic. You bet.

Cash-flow matters. It matters much more than absolute wealth, share values, numbers on a bank statement. Wealth can be used to create cash-flow – or not. So when we sat down to create our financial plan to FIRE, our focus was on cash-flow first and foremost. Understanding each of the major cash-flow streams and how they contributed to our annual expenditure needs meant we could identify the gap we needed to plug to become Financially Independent.

That might sound complicated and have you running back to the 25x rule – but it’s not & we’ll go through it step by step here. Trust me, it’s worth doing to really understand and believe in your plan.

Begin At The Start

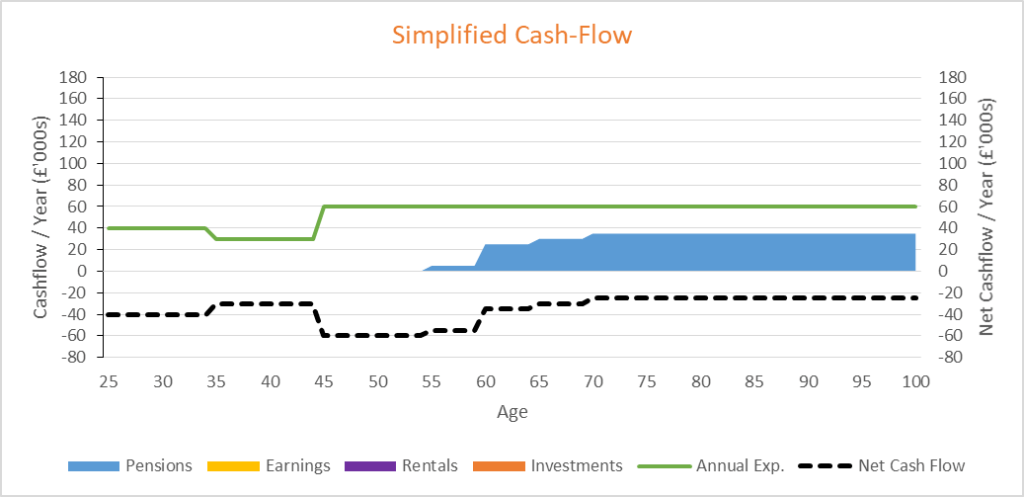

First things first – what does a basic cash-flow plan even look like? Essentially you are looking to identify your major sources of income and plot those out along your expected lifetime. Before we get into adding those – first you want to start with what we already have from Playing The Fire Triangle – Life Scope, i.e. our expenses. So something like this;

Here, on the y-axis, we have annual income/expenditure. In our case in £’s but obviously in whatever is your main currency. For simplicity sake we’ll be assuming all values have been converted into so-called ‘real’ values. All this means is that we’re comparing apples with apples – so £20k in 2075 can be considered the same as £20k today – it’s been adjusted for inflation. In reality the £20k in 2075 would be a larger number depending on that pesky inflation and we’ll get into that in another post – but for now, this will work.

On the x-axis we have our age. We started roughly around 25 ( not that we actually knew it! ). We made a very (very….) conservative estimate of both living to 100. You can actually get an estimate for this from various actuary websites – but be warned it can be eye-opening – not always in a good way!

The coloured bars along the bottom here are our five main categories of income/wealth. Rentals was specific for us but take it as any kind of side-business you run. These should work for most people but again, adjust as you see fit.

Finally, the green line is simply our annual expenditure, both actual and estimated. You have these numbers already from the exercise in part one of Playing The Fire Triangle….right 😉 Whilst these numbers are illustrative, our green line goes down from becoming mortgage-free through building our own house. Then it goes up post FIRE to reflect all the extra money we plan on spending now that we have more time.

Now we’ve got that sorted – let’s get on with filling in this graph…

Your Cash Flow Needs Are Not A Straight Line

One of the first problematic assumptions of the 25x rule & SWR is that they are based on you making the same withdrawal year-on-year. Now put this against the fact that most people who are following FIRE will have some kind of pension savings, taking advantage of their tax breaks. You can quickly see that on an annual basis – the amount of cash you need your investments to provide is going to change. So if we now add our expected pension income (again, all real values, i.e. inflation adjusted ) to our graph we get something like this;

The blue area is made up of different pensions kicking in as we get older. So SIPP’s from 55 (update, will now be 57, thanks UK Gov!) and work pensions between 60 – 65 . Then finally the state pension at 70. Perhaps. To be honest – we’ve only included 25% of this value as we not willing to really count on this last one given the state of the UK finances. Again – this is an assumption you need to decide on for yourself based on your own country.

What’s important to note is the gap between the green line and the blue area – represented by the dotted black line plotted on the second axis. What this is showing you is your shortfall between what you want to spend each year and what income you have coming in. Unsurprisingly at this point, it’s in negative territory. Not to worry, we’ll get to sorting that out soon.

For now – just notice the shape – very definitely not a straight line. Unsurprisingly, we need to generate less cash-flow/year once our pension savings kick in. And more cash-flow/year beforehand. This is one of the reasons why the 25x rule is a blunt short-cut. What we actually need to do is create a cash-flow/year profile to match the black dotted line.

In order to do so – we need to add a few more things to this graph. So let’s now move on to ‘Earnings’ and see what that does to it all.

Selling Time For Earning Money

Otherwise more commonly known as being employed in some form or another. Selling your time to others for earning money is still the most ‘normal’ way for folks to earn cash.

Assuming you fall into this group, you’ll want to now add your annual (post-tax) earnings onto this graph. Something like this;

Starting to look a little more interesting now isn’t it? The yellow block here represents for us (illustrative rough numbers) our combined earnings. So some decent increases as I progressed through the ranks and S went self-employed. Then the big drop off as I quit and S cut down on clients.

Important thing here is to see the NCF (Net Cash Flow) line is now healthily above both zero and our annual expenditure rate.

Spend Less, Earn More. The FIRE seeker’s mantra.

This is what lets you save and create wealth to turn into passive investment sources. Freeing you from the need to continue to sell your time, if that’s what you want.

In which case – we’d better add in those passive income sources, right?

Making Your Money Do The Work For You

Ah, the dream. Risk-free income without doing anything for it. Sadly this is one of those magic unicorn things that just doesn’t exist. Everything comes with risk, you just have to decide what’s right for you.

When putting your hard-earned wealth to work, you want to make sure it’s doing the most for you that it can, whilst understanding and accepting the risks that come with that. And you really want to be, at least, beating expected inflation. All of those things I’ll go into more in a future post but for now – what we’re adding here is our passive income sources.

There’s a lot of discussion on FIRE blogs about the importance of a diversified investment portfolio – and quite rightly so. What’s not so often discussed is the diversification of sources of earnings & liquidity risk. Again, one for later. But in short, there’s a lot of different ways to invest your wealth and a lot of people with different ideas and approaches. For now, I’m keeping it simple here and calling all our different financial investments simply ‘investments’.

That sorted, for us we had two main strands under passive income – property and investments. I’d actually argue that property was far from passive the way we did it ( another post… ) but it did generate both income and wealth and another big step on our journey to FIRE. So adding both of those to our graph now gives us something like this;

Pretty busy looking now eh – this is a stacked contributions graph. Few things to note here. The first thing you might notice is that the annual contribution from our investments (orange) goes down to zero before going back up again. No, we didn’t lose it all through betting on black or picking a ‘sure-win’ share that nose-dived later. We invested our savings into two things – building our own home mortgage free and growing our rentals business.

Building our own home (another post soon) was a big step for us. By doing far more of the work than we expected to we were able to do so through savings and no mortgage. We made a healthy return on our time this way too. This is also why you see our green expenses line decrease at 35 – as at this point we no longer had a mortgage.

You can see the rentals (purple) contribution growing as we likewise invested into more properties – and then decreasing as we sold out of them. Yet another blog post to come here. We invested the proceeds back into more passive investments – effectively giving them a big boost each year through this and obviously our excess cash flow from still working and spending less than our expenses.

I realise at this point if you aren’t used to dealing with numbers you may be feeling a little overwhelmed. This is why so many people love the 25x rule – it’s simple, it’s easy. And at this point I understand you might well be thinking is this really worth all the extra effort. My answer – yes. And the next section will explain why.

To Inherit Or Not To Inherit, That Is The Question

Ok, it’s not the only question but it is a big one. And unsurprisingly it can have a material impact on your FIRE number.

If you managed to read Mad Fientist’s blog on this as suggested – you’ll know already that the 25x rule is incredibly conservative when it comes to this. After 30 years it has a pretty staggering 96% probability of leaving you with more than you started with. That’s right – perhaps unsurprisingly – if your real rate of return post inflation & taxes is higher than your annual withdrawal rate, based on historic data from US markets (another glaring assumption for us UK folk), you’ll have more money left when you die than when you started withdrawing it.

For us, with no kids, this wasn’t an assumption we agreed with. Our approach is to depart this world leaving behind some good memories and helping people whilst we’re alive, not afterwards. We have our mortgage-free home as contingency savings already – so why would we want to be quite so conservative with our financial planning?

And this is when the hard work of doing your own cash-flow forecasting really pays off. You can look at what you actually need – and when. You can shape your investments to payout more earlier, less later – accepting the increased risk of ending up with less money at the end. Planning to end up as close to zero as you are comfortable taking it. After all, £1m will last 20 years living on £50k/year even if you simply keep it under an inflation-matching mattress! If you know you have other pension income kicking in, you can afford to front-weight your other investments. But again, it’s all personal choice.

Everybody will have their own unique combination of sources of income, expenses and attitude to risk. A blunt rule of thumb doesn’t let you optimise your FIRE number or understand the impact of your choices (part three of the FIRE Triangle). It can mean you spend longer reaching a number that you don’t need to reach.

But sequence risk matters. Ignore it at your peril. You don’t want to front-load your investment payouts so much that if you hit a few bad investment return years in a row, you’re going to get wiped out. Whilst the 25x rule may be too conservative for us – you don’t want to go to the other end of the spectrum. No point celebrating lowering your FIRE age just to see all your hard-earned cash wiped out.

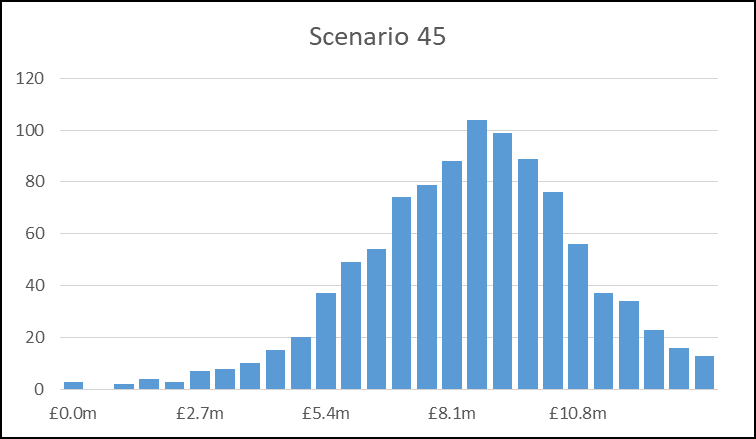

Choose Your Own Risk Acceptance

So – if not the 25x rule – what did we do? In explaining our cash-flow graphs I’ve talked a lot about ‘what we did’ as lot of these numbers are in the past now for us. Back when we calculated our FIRE number though we modelled our cash-flows going forwards. Although I’m the maths geek of our partnership, I think I mentioned already that S is a genius with Excel. He built us an awesome spreadsheet that incorporated all our cash-flows, inflation, taxes and expected rates of returns from investments we would put our funds into. Etc etc. It produced funky graphs like these guys;

I’m not going to go through these ones and I’m not suggesting you need to build your own version. There are lots of great people in the FIRE community who already provide free versions.

What I am suggesting (strongly…!) is that it’s worth your time and effort to go through the details on this. Take the time to plan out all your cash-flows – and work backwards to solve for the wealth needed to fund them at risk levels you are comfortable with.

Understand the assumptions you are making, either on purpose or by default accepting others. The more you understand your plan – the greater your ability to trust it – and adapt it when inevitably you will need to do so.

S0 - When Can I Retire?

The big question right – all this talk about cash-flow is lovely and all – but when can I start living the balanced life I want?

This is the real fun part where you get into examining your choices, identifying your biggest financial levers and balancing everything up to what works best for you.

But that’s all in part three and four of Playing The Fire Triangle.

In the meantime – get on with working those cash-flows and let me know how you get on below!

Totally agree with you on cash flow. When we first started on this journey we had a net worth number in mind that worked w h the safe withdrawal rate. But then we came to realize that the simple calculation didn’t work for us because not all of our investments were liquid (nor did we want them to be) and although we factored our home into our net worth calculation it didn’t really relate to our FI number.

Now we are focusing more on cash flow. As real estate investors this make sense for us. It is also one of the main driving factors in wanting to be mortgage free (again).

Great post. Looking forward to reading part 3.

Exactly. Net worth and the like is fine – but it’s a short-cut and doesn’t work well when you dig into your real-life situations. I think perhaps this becomes clearer for most people the closer you get to actually pulling the trigger.

It’s good to hear you are well on your path and have figured out how to make the numbers work for you. The real estate play worked out well for us but you really do need to know your market. Sounds like you got that sorted!

Thanks again for the feedback – look forwards to hearing more from you too.

Got around to checking out your blog this morning. Great stuff, well written and a captivating life story in the “About” section. Love the contrarian approach to life!

Look forward to seeing more – have signed up to email notifications!

Cheers

Cheers BoF – means a lot coming from you, I really enjoy your posts.

Ha – yeah – I think being a natural contrarian is a bit of a head start on the FIRE path 😉

It’s cool you managed to sign up – appreciated!